Okay, let’s just dive in because honestly I’m sitting here at my kitchen table in [Midwestern city redacted for privacy but think strip-mall-and-snow kinda place], February 2026, staring at my latest credit card statement like it’s personally insulted me.

The US-China trade standoff affects your wallet in 2025 (and bleeding into right now) way more than the talking heads on cable news make it sound. Like, I knew tariffs were a thing—Trump-era stuff never fully went away, Biden tweaked ’em, then this latest round of tit-for-tat just kept piling on—but I didn’t expect to feel it this hard in my day-to-day. Seriously. My grocery run last weekend? Brutal.

Why the US-China Trade Standoff Affects My Grocery Bill So Much

I used to be that guy who bragged about getting a cart full for under $120. Not anymore. Last Saturday I dropped $168 at Kroger and I didn’t even buy anything fancy—no organic kale smoothies or whatever. Just normal stuff: chicken thighs up almost 30% from two years ago because feed and some packaging components still loop through China supply chains, canned goods with weird little price jumps because aluminum and steel tariffs never fully unwound, even the freaking tortilla chips cost more since packaging film prices spiked again.

I stood there in the aisle holding two different bags of frozen veggies—one from California, one “product of China/processed in Vietnam”—and the China-linked one was somehow cheaper but I skipped it anyway because I read too many articles about quality control. Then I felt dumb for paying extra. Classic me.

- Chicken: $3.99/lb → now flirting with $5.29/lb on sale

- Coffee pods: box of 40 went from $18.99 to $24.49

- Basic ibuprofen: generic bottle up a dollar because active ingredients or bottles or something trace back through the mess

It’s not just “inflation.” It’s the US-China trade standoff affects wallet reality hitting the stuff I touch every day.

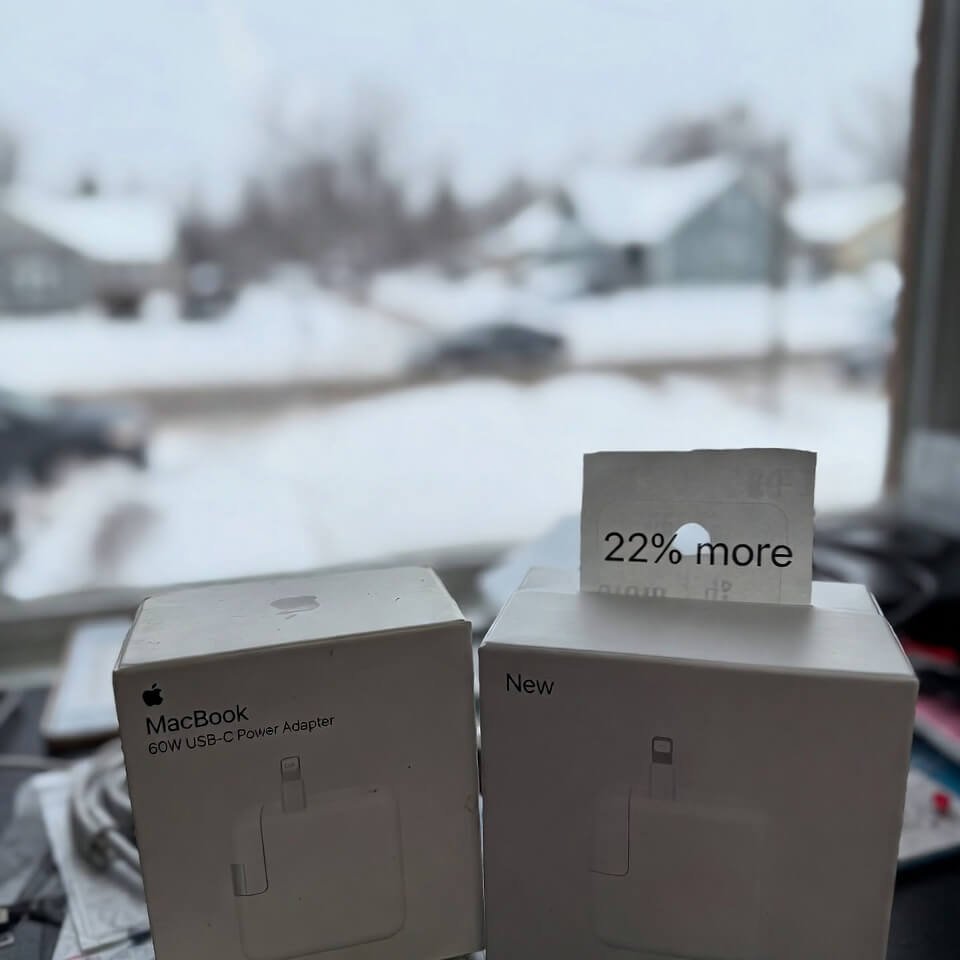

Electronics and Gadgets Are Getting Crushed Too (My Dumb Purchase Story)

I finally caved and replaced my dying noise-canceling headphones last month. Same brand I bought in 2023 for $149. This time? $219. Same model, basically. I asked the Best Buy kid why and he just shrugged and said “tariffs and shipping, man.” I paid it because my ears hurt on Zoom calls all day working from home, but I hated myself a little.

The trade standoff between US and China keeps jacking up import costs for anything with chips, screens, batteries, or even the little screws. My kid’s Christmas wishlist this year had a tablet on it—same one from last Black Friday was $80 more. I bought a refurbished one instead and felt cheap, but also kinda smart? I don’t know. I’m contradicting myself already.

If you’re thinking about upgrading your phone, laptop, anything tech—do it sooner rather than later. The longer this drags, the more the US-China trade war impact on consumer prices is gonna sting.

Gas, Cars, Random Household Stuff—It All Sneaks In

Even though oil isn’t directly China, the ripple is real. Car parts, tires, even some interior plastics—tariffs layer on and dealers pass it down. My neighbor just bought a new pickup and said the sticker was $4k higher than he budgeted because of “supply chain crap.” He blamed China. I nodded like I understood, but really I’m just over here wondering if my 2018 Honda is gonna make it another three years.

Household crap too: my wife’s favorite throw blanket from Target—same one we bought in 2022 for $29—now $42. Same tagline, same picture. Just… more expensive.

What I’m Actually Doing About It (Mostly Failing But Trying)

Look, I’m not some prepper guy stockpiling rice. But here’s the messy, imperfect list of what I’ve tried:

- Switched to Aldi for 70% of groceries—saves maybe $30-40 a trip but their selection sucks sometimes

- Using gas apps religiously now. Saved like $8 last month. Wow, big whoop

- Holding off on big buys—my TV still works fine, even if the colors are kinda washed

- Buying American-made when I can spot it (surprisingly hard for basics)

- Cutting streaming services down to two. Felt dramatic but saved $35/month

Most of this is bandaids. The US-China trade standoff affects wallet reality isn’t going away quick.

Wrapping This Up Before I Spiral

I don’t have answers. I just know that opening my banking app these days feels like getting a parking ticket in the mail—annoying, confusing, and somehow my fault? I’m annoyed at politicians, annoyed at companies passing costs on, annoyed at myself for not budgeting better back when things were cheaper.

If any of this sounds familiar, drop a comment. Tell me what you’re seeing in your cart or your Amazon cart regret. Maybe we can commiserate. Or if you’ve found some hack that’s actually working in 2025/2026, share it—because I’m clearly winging it over here.

Stay thrifty, friends.

— Montu (just a dude in the Midwest trying not to go broke)

For more context on the latest tariff moves:

- Council on Foreign Relations explainer on current US-China trade tensions

- Reuters piece on 2025 consumer price impacts (search their site for recent trade tariff updates)

- Bureau of Labor Statistics CPI data — check imported goods categories yourself