Sectors booming from trade tensions are seriously the only thing I’ve been able to talk about at barbecues lately without people glazing over, and honestly it’s because I’m low-key terrified and kinda hyped at the same time.

Like, right now I’m sitting in my cramped home office in a suburb outside Raleigh, North Carolina—window cracked because the AC is acting up again—listening to the neighbor’s leaf blower while I sip lukewarm black coffee from a mug that says “World’s Okayest Dad.” And every time another tariff headline drops, my brain does this weird flip between “hell yeah, bring jobs back” and “oh crap, my 401(k) is gonna feel this.”

So here’s my unfiltered, probably flawed take on the top 7 sectors that could straight-up boom if these trade tensions keep escalating. This isn’t financial advice—I lost a decent chunk on some EV stock last year because I thought I was smart—so take it as one anxious American dude rambling.

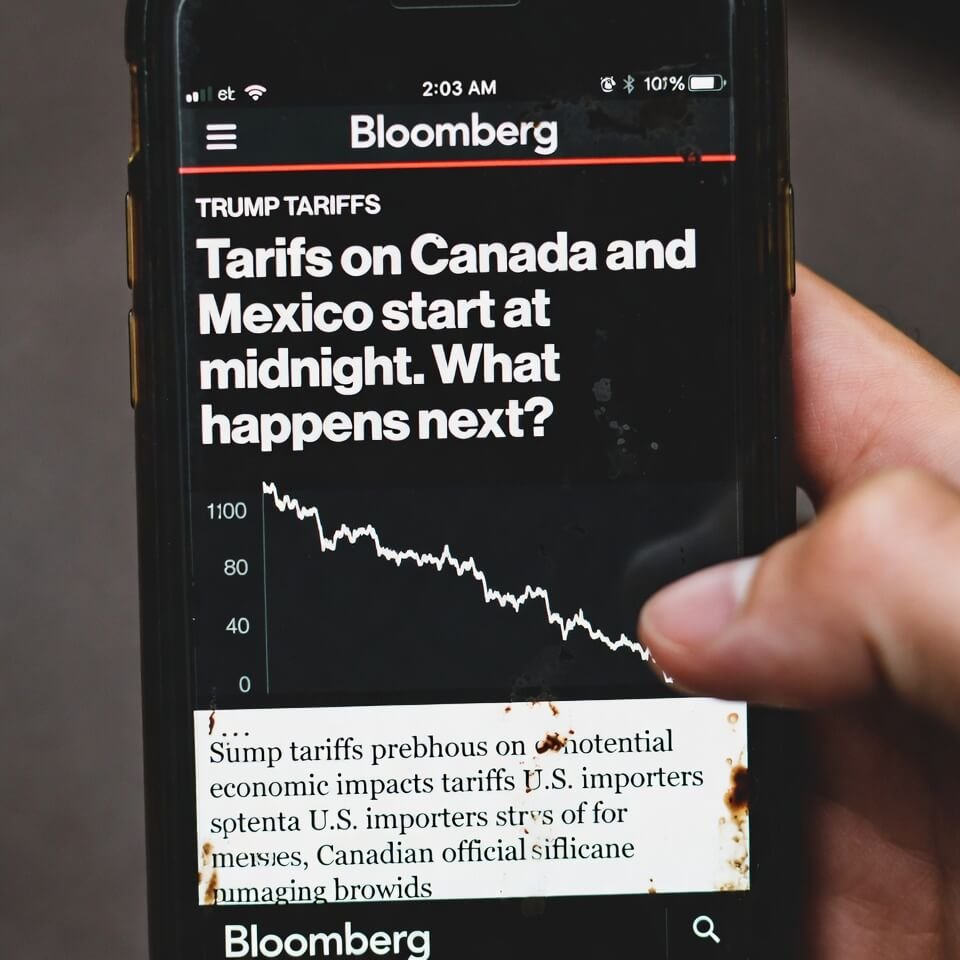

Why Trade Tensions Suddenly Feel So Personal in 2026

Man, it used to feel abstract. Now it’s the price of the sheet metal that goes into the new gutters I need (thanks, hail storm), or why my buddy who works at the local auto parts place suddenly has overtime out the ass. Tariffs aren’t just headlines anymore—they’re hitting the Home Depot receipt and the grocery bill in sneaky ways.

1. Domestic Steel & Aluminum – The OG Tariff Babies

I remember when the first big steel tariffs hit back in the late 2010s. My cousin in Pennsylvania sent me a pic of his dad’s old steel mill parking lot filling up again with trucks. Fast forward to now and every time China or whoever gets slapped with another round, US steel producers basically do a quiet fist pump.

- Nucor and Cleveland-Cliffs stock gets twitchy in a good way

- Construction costs go nuts short-term but domestic mills print money longer-term

- I legit bought a small position in a steel ETF last month after seeing rebar prices spike at my local supplier—probably dumb but felt patriotic for like five minutes

2. Semiconductors & Chip Manufacturing – Reshoring on Steroids

Look, I’m typing this on a laptop that’s 40% more expensive than it should be because of supply chain nonsense. But Intel’s new fabs in Ohio and Arizona? TSMC’s Arizona plant? Those things are real now. Trade tensions basically lit a fire under Congress’s butt with CHIPS Act money.

If tensions keep rising, expect more “Made in USA” silicon. My neighbor’s kid just got a job at one of those facilities—starts at like $25/hr with overtime and he’s 19. Wild.

3. Renewable Energy Components (Solar Panels, Wind Turbines, Batteries)

This one’s messy because we still import a ton from Asia, but tariffs on Chinese solar panels and batteries are pushing domestic production hard. First Solar’s stock has been on a tear whenever tariff talks heat up.

I tried installing solar on my roof last summer—got quoted, saw the import-dependent price, then saw the “Made in USA” option that qualified for bigger tax credits. Guess which one I picked? Yeah. Domestic battery makers like those in Georgia and Michigan are licking their chops.

4. Heavy Machinery & Agricultural Equipment

John Deere, Caterpillar—every time trade talks get spicy, these guys get a little bump because farmers and builders start looking stateside instead of waiting on delayed shipments from overseas. My uncle in Iowa replaced his combine last year and went full American-made for the first time in forever because lead times were insane.

5. Defense & Aerospace Contractors

This one feels icky to celebrate, but yeah—trade tensions plus geopolitics = bigger defense budgets = Lockheed Martin, Raytheon, Northrop Grumman grinning. I toured the Boeing plant in South Carolina once (friend’s dad worked there) and the amount of “Made in USA” signage was almost comical. More tensions = more contracts.

6. Pharmaceuticals & Generic Drug Manufacturing

We got burned hard during COVID on supply chains. Now every tariff threat makes politicians scream about bringing back API (active pharmaceutical ingredient) production. Companies like Phlow and some of the bigger generic players are expanding US facilities fast. My wife’s blood pressure meds switched manufacturers last year—turns out the new one is made in New Jersey. Felt weirdly reassuring.

7. Logistics & Warehousing (The Quiet Winner)

Everyone forgets this one. Ports get clogged, imports slow, companies build bigger warehouses inland to stockpile. REITs focused on industrial space (Prologis, etc.) quietly kill it during trade spats. I drive past new distribution centers popping up on I-85 like weeds—someone’s making bank.

Look, I don’t have a crystal ball. Half the time I think we’re heading for a soft landing, the other half I’m panic-buying canned goods like it’s 2020 again. But these sectors? They’re the ones I keep circling back to whenever another round of “tariff this, sanction that” hits the feed.

What do you think—am I missing one? Or am I just a paranoid dude in a home office oversharing? Drop a comment if you’re watching any of these play out in your town too. I read every single one, even the ones calling me an idiot. Especially those.