Stock market and tariffs—man, if those words don’t make my stomach drop faster than a missed earnings call I don’t know what does. I’m sitting here in my apartment in [redacted mid-size US city], it’s like 43 degrees outside which is basically winter torture, the radiator is clanking like it’s about to explode, and I’m staring at my portfolio down another 2.3% today because apparently new tariff announcements dropped overnight. Again. Seriously.

I used to think tariffs were just something politicians yelled about during election season. Like, okay cool, politics, whatever. Then 2018 happened, my dumb ass had just started investing with the $800 I saved from not going out for six months, and bam—steel and aluminum tariffs tanked a bunch of my industrial ETFs. I panicked, sold at the bottom, bought back higher like a total rookie. Lost like $240. Which doesn’t sound like much now but back then it felt like my entire net worth evaporated. Anyway.

Why Tariffs Keep Screwing with the Stock Market (My Personal Nightmare Edition)

Tariffs are basically taxes on stuff coming into the country. Government slaps extra costs on imports → companies pay more → they either eat the cost (profit margins die) or pass it to you (inflation says hi). And the stock market? It hates uncertainty more than I hate doing my taxes.

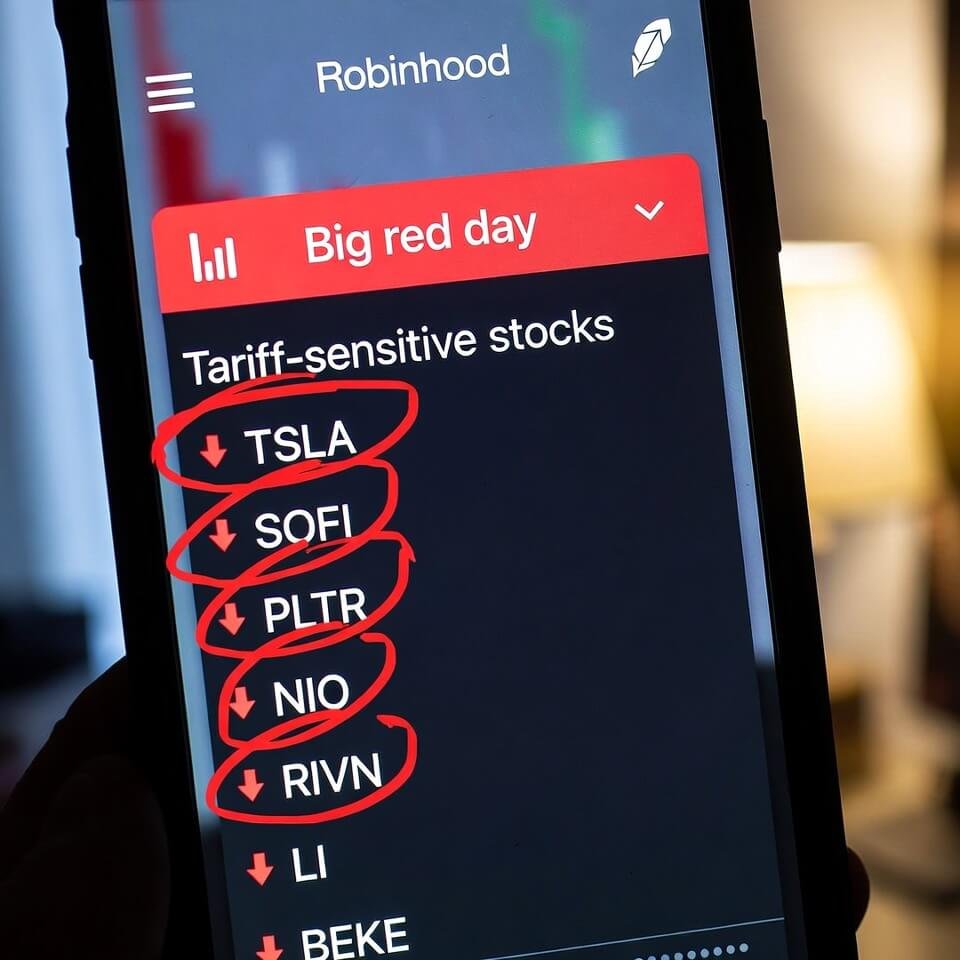

Right now in 2026 we’re back in it. New rounds of proposed tariffs on basically everything from China, maybe Europe too depending on who’s yelling loudest in DC. My tech holdings get twitchy because chips and components cross borders like five times before your phone’s even assembled. Consumer stocks? Forget it—Walmart and Target already warning about price hikes.

- Imported goods get pricier → inflation ticks up → Fed maybe keeps rates higher longer → stock valuations get crushed

- Companies with big overseas supply chains (Apple, Nike, etc.) see margins squeezed

- Domestic manufacturers sometimes win short-term (steel stocks pop) but then retaliation hits exports

- Whole sectors swing wildly on every tweet, I mean post, from whoever’s in charge

I literally have alerts set for the word “tariff” now. My phone buzzes at 2 a.m. sometimes and I wake up sweating thinking it’s another 25% on semiconductors.

The Dumb Things I Did When Tariffs First Hit (and Still Do)

Look, I’m not proud. When the last big wave hit:

- I day-traded tariff headlines like an idiot. Bought a steel stock at open, sold at lunch, lost 7% in four hours.

- I panic-read Reddit threads at 3 a.m. and convinced myself to go all-in on “tariff-proof” utilities. Spoiler: nothing is tariff-proof when the whole market’s scared.

- I stopped contributing to my 401(k) for like two months because “why bother if it’s just gonna get tariffed away.” Great logic, Montu. Real smart.

Now I try to be less stupid. I keep a little cash on the side so I’m not forced to sell low. I diversified more into services-heavy companies that don’t rely on physical imports as much. Still hurts though.

How Tariffs Actually Hit Your Everyday Life (Beyond the Red Portfolio Screen)

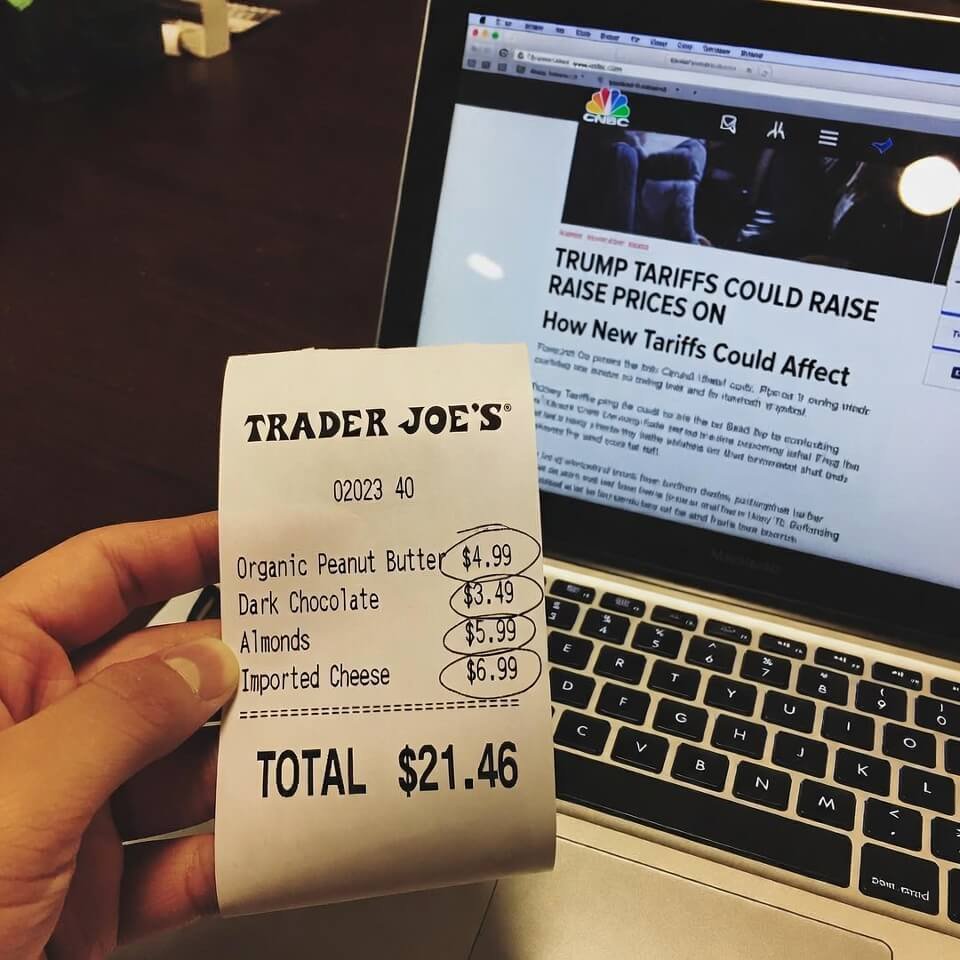

You think it’s just Wall Street? Nah. Last time I went to grab beer and wings with friends, the tab was noticeably higher. “Import fees,” the bartender shrugged. My Costco run last month—those Korean ramen packs I’m addicted to jumped almost 30%. And don’t get me started on electronics. I’ve been nursing this cracked iPhone screen for six months because a new one would cost what feels like a kidney thanks to supply chain + tariff math.

It’s weirdly personal. You see the numbers on CNBC, but then you feel it at the pump, at the grocery store, in your Amazon cart. Makes the stock market feel less abstract and more like “this is actively making my life more expensive.”

Okay But What Should a Beginner Actually Do About Stock Market and Tariffs?

Here’s what I’m trying to stick to these days (key word: trying):

- Don’t try to time tariff news. You will lose. The market usually overreacts then corrects.

- Own broad index funds (S&P 500, total market). Tariffs hit some sectors harder but the whole economy usually muddles through.

- Keep some dry powder. Having cash means you can buy the dip instead of crying during it.

- Pay attention to companies that disclose tariff exposure in earnings calls. If management sounds chill about it, maybe they’ve got a plan.

- Zoom out. Tariffs come and go. The market’s been through worse. Still went up long-term.

I’m not saying ignore it. I’m saying don’t let it paralyze you like it did me for way too long.

Wrapping This Up Before I Stress-Eat More Tacos

Stock market and tariffs are gonna keep being a thing, probably forever. It sucks, it’s confusing, it costs me money and sanity. But I’m still here, still investing small amounts every paycheck, still learning the hard way. If you’re new to this and freaking out because your app is red—same. You’re not alone. Drop a comment if you’ve got a dumb tariff-related investing mistake. Misery loves company.