Tariff announcements hit me harder than earnings season ever has, and I’ve been burned by plenty of both. Right now it’s mid-February 2026, I’m holed up in my little home setup just outside Raleigh, the heat’s running full blast because it’s that damp 40-degree Carolina nonsense again, and my phone keeps buzzing with push notifications about some fresh tariff talk coming out of the White House. My hands are literally clammy. Earnings calls? Those I can prep for, model out, maybe even laugh off a bad guidance print over beers later. But tariff announcements? Man. That’s the market equivalent of someone yanking the power cord mid-game. No warning, no analyst preview, just sudden chaos that makes your whole book look stupid overnight.

Why Tariff Announcements Feel Like Getting Punched in the Throat

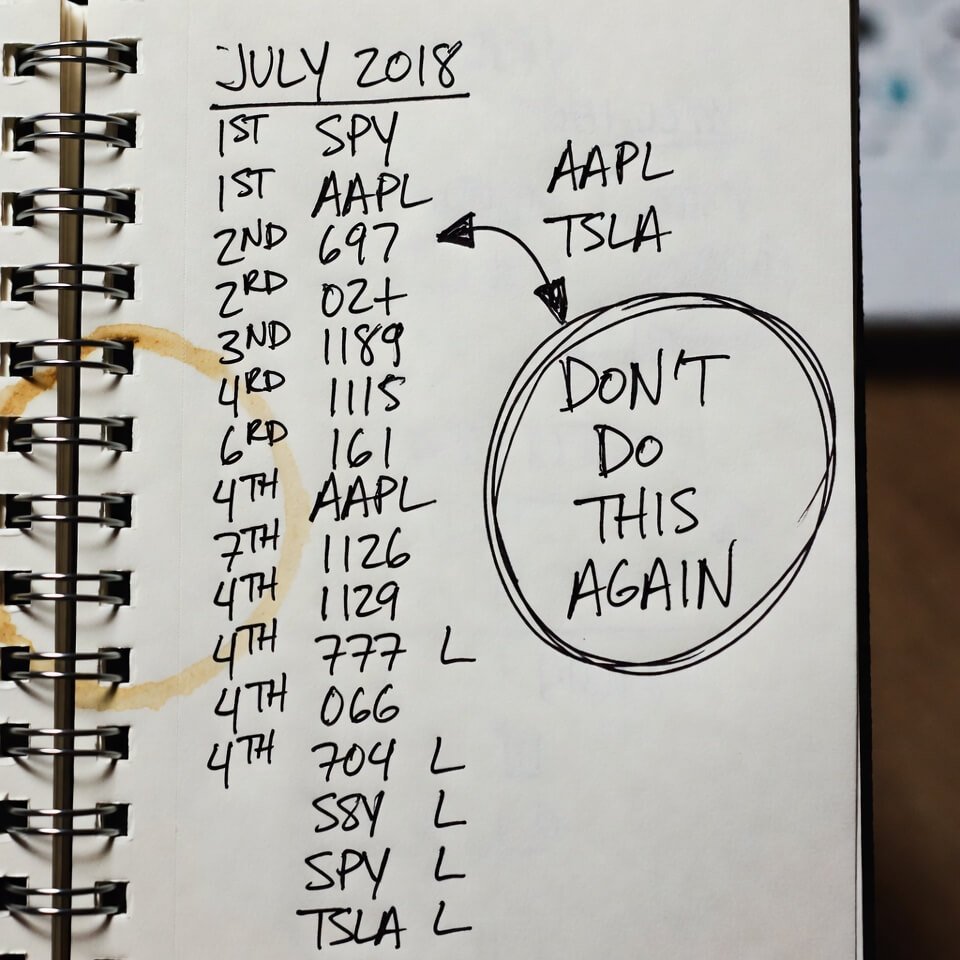

Back in 2018 I was still figuring shit out. Lived in this shoebox apartment near Duke, trading off a IKEA desk that wobbled every time I typed. Thought I was killing it catching post-earnings pops on semiconductors and cloud names. Then one random Tuesday Trump fires off a tweetstorm about another $200 billion in China tariffs. I watched my SPY calls evaporate in like twelve minutes. Sold half the position at -19% just to stop the bleeding, then sat there eating leftover cold Chinese takeout straight from the carton while the rest kept sliding. Felt personal. Earnings whiffs sting because you misread the company. Tariff news feels like the entire system just decided to screw you for fun.

Here’s the quick breakdown that still pisses me off:

- Earnings calendars are public knowledge six months out. You know when the reports drop.

- Tariff stuff? Could be a midnight tweet, a Sunday morning Fox interview leak, or some random USTR filing nobody saw coming.

- One hits a single stock or sector. The other ripples across everything—autos, tech, ag, retail, even consumer crap you didn’t think was exposed.

- VIX pops like it’s on Red Bull during tariff season. Earnings volatility is tame by comparison.

I still jump a little every time Maria Bartiromo or whoever starts saying “Section 301” on TV. It’s embarrassing how conditioned I’ve become.

The Dumb Shit I’ve Done Because of Tariff Panic

I’m not proud of all of it.

First big one: 2019. I loaded up on Caterpillar and Deere the night before a supposed tariff “deadline.” Figured markets were overreacting and it’d get kicked down the road again. Nope. Announcement came, stocks gapped down hard, I ate like 13% in one day on leveraged ETFs. Learned that “this time they’re bluffing” is the dumbest sentence a trader can say out loud.

Second: tried playing the rumor game last spring with puts on a China-heavy ETF. Headline fizzled by lunch, I got theta-gamed into oblivion. Threw good money after bad trying to average down. Ended up explaining to my wife over takeout wings why our vacation fund took a haircut. She just stared at me like “you’re doing this again?”

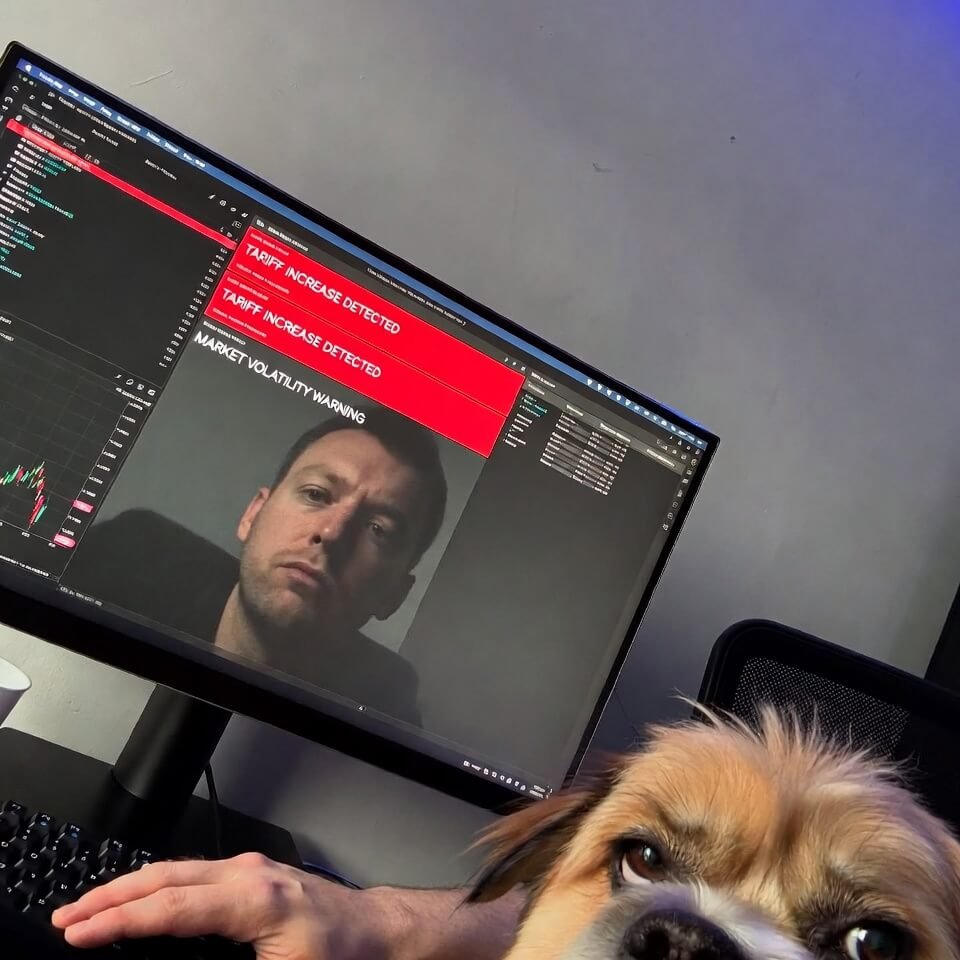

Worst though? The doomscrolling. I used to keep Twitter (sorry, X) open 24/7 waiting for the next shoe to drop. Now I at least try to shut it at 9 p.m., walk the dog around the block even when it’s misting, but I still catch myself checking headlines in the bathroom at 2 a.m. like some kind of addict.

Tariffs mess with your psychology more because they’re political theater, not quarterly math. You can’t spreadsheet your way around a president’s mood swing or a senator’s soundbite.

Earnings vs Tariff Announcements – Head-to-Head (No BS)

Earnings season has structure:

- Dates locked in forever.

- You can position straddles, iron condors, whatever.

- Post-print move usually fades unless guidance is nuclear.

Tariff announcements are lawless:

- Zero heads-up most of the time.

- Retaliation roulette—China hits pork farmers, EU hits bourbon and motorcycles, suddenly unrelated names tank.

- Fear premium lingers for weeks even if nothing concrete passes.

- Whole sectors can get painted with the same brush regardless of fundamentals.

I’d genuinely rather eat a surprise Fed hike or a weak nonfarm payroll than wake up to fresh tariff rhetoric.

The Half-Assed Ways I Cope Now (They Don’t Always Work)

I’ve got a stupid little checklist taped to the monitor:

- % revenue from tariff-exposed countries

- Input cost sensitivity

- History of passing price increases along

- If it’s >12–15% China exposure and no clear workaround → tiny position or skip entirely

I force screen breaks after market close. No more midnight refresh loops. I tell myself 80% of the bluster never becomes law anyway.

But I still screw up. Last month I got greedy on a materials name right before a Section 232 rumor. Rumor died, position died, premium gone. Shrugged, added it to the “lessons” tab in my journal, moved on.

Final Ramble

Tariff announcements scare me more because they remind me the market isn’t just numbers—it’s people with agendas, egos, elections. Earnings are at least somewhat knowable. Tariffs feel like the house rules changed while you were in the bathroom. If you’ve ever panic-sold into a tariff headline or stubbornly held through one, drop it in the comments. What’s your dumbest tariff trade? Or are you one of those robots who just yawns through the whole thing? I need to know I’m not the only one losing sleep over this crap.

Stay liquid. And maybe keep the phone face-down at dinner.

For a decent non-hysterical take on how tariffs actually shake out long-term, this CFR explainer is solid: https://www.cfr.org/backgrounder/what-are-tariffs

And if you want data on the 2018–2019 volatility spike, the NBER paper here is worth skimming: https://www.nber.org/papers/w25672

Catch you next freakout.