Trade war trading tips are honestly the only thing I’ve been thinking about for the last three weeks straight while sitting in my home office in [redacted small Midwest city], listening to the neighbor’s leaf blower at 7 a.m. like it’s some kind of personal attack.

Seriously, every time these US-China trade war headlines flare up again—and they do, like clockwork—I feel that same pit in my stomach I felt back in 2018 when I was still dumb enough to be almost 70% in individual tech names. My 401(k) statements looked like crime scenes. I literally refreshed CNBC at 2 a.m. while my wife was asleep next to me whispering “go to bed, you’re scaring the dog.”

Why Trade War Trading Tips Matter More Than Ever Right Now

Look, I’m not some hedge-fund guy with a Bloomberg terminal and a private jet. I’m just a regular dude who works a day job, trades on Robinhood and Fidelity when the kids are finally in bed, and tries not to blow up the emergency fund.

But here’s the raw truth: trade wars don’t just “happen over there.” They hit Main Street portfolios hard. Soybean farmers in Iowa get crushed, chipmakers in California bleed, auto parts suppliers in Michigan lay people off, and suddenly my boring old index funds are down 8% in a week because everyone panics at the same time.

I learned this the hard way in 2019. I panic-sold a chunk of my Apple position right at the bottom of one dip after reading some scary tariff tweet. Bought back in three weeks later at like +12%. Classic retail investor facepalm moment. Cost me thousands. Felt like an idiot for months.

My Go-To Trade War Trading Tips That Actually Help (Most of the Time)

Here’s what I’m sticking to these days instead of doom-scrolling X at midnight:

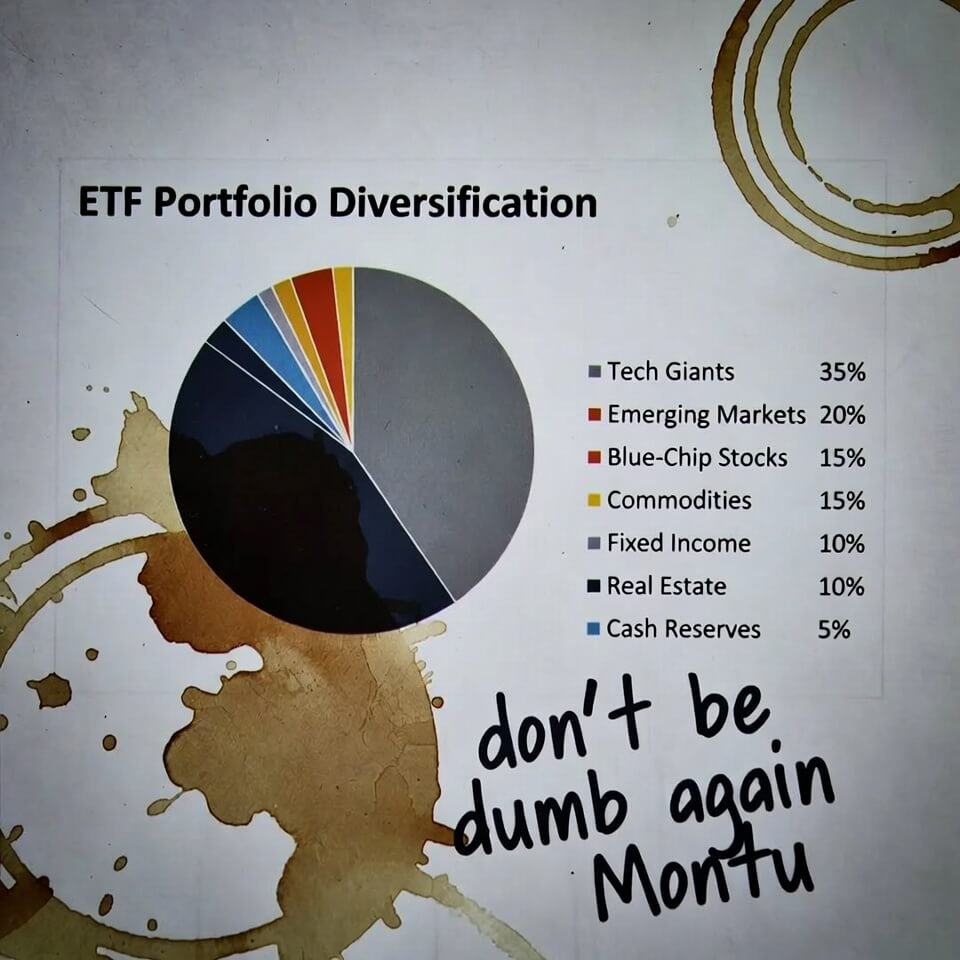

- Diversify beyond the obvious tech darlings — I used to think “buy more semiconductors because AI” was smart. Turns out when tariffs target chips, everything downstream gets smoked. Now I keep about 25-30% in broad-market ETFs like VTI or SCHB that spread the pain around.

- Cash is not trash during tariff tantrums — Holding 10-15% cash feels painful when everything’s ripping, but when the headlines hit, being able to buy the dip without selling something else at a loss? Priceless. I keep mine in a high-yield savings account paying like 4.5% right now. Not sexy, but it buys me sleep.

- Watch the sectors that actually get tariffed first — Steel, aluminum, washing machines, solar panels, electric vehicles, semiconductors. If the news mentions 25% on Chinese imports of XYZ, I look at my holdings in anything remotely related and ask: “Can this company pass the cost on or are margins getting nuked?” Usually the answer is ugly.

- Stop trying to time the exact bottom — I used to think I was gonna catch the knife. Spoiler: I didn’t. Now I dollar-cost average into quality names I already like when they gap down 5-10% on trade-war noise. Slow and boring wins.

- Read the actual Section 301 announcements, not just the headlines — CNBC will scream “TRADE WAR ESCALATION” but the devil is in the product list. I literally pull up the USTR.gov PDF and Ctrl+F for keywords like “semiconductor” or “lithium-ion battery.” Saves me from reacting to clickbait.

For more on the latest rounds, check out the official U.S. Trade Representative tariff lists — dry as hell but way more accurate than Twitter.

The Dumb Mistakes I Still Make (So You Don’t Have To)

Last month I got cute and bought a bunch of calls on CAT thinking infrastructure spending would offset any steel tariffs. Spoiler: the market didn’t care about my brilliant thesis. Down 18% in ten days. I still check that position every morning and hate myself a little.

Also I once averaged down into Boeing during the 2019 trade spat because “they’re too big to fail.” Turns out trade wars + 737 MAX issues = very expensive lesson in not fighting the tape.

Bottom Line (From One Flawed American Investor to Another)

Trade war trading tips aren’t about getting rich quick—they’re about not getting poor slowly. Protect what you already have, stay diversified, keep some dry powder, and try not to let the 24/7 news cycle turn you into a twitchy mess.

I’m still figuring this out myself. My portfolio isn’t perfect, my entries are sloppy sometimes, and yeah I still check prices way too often while drinking room-temperature coffee at my desk.