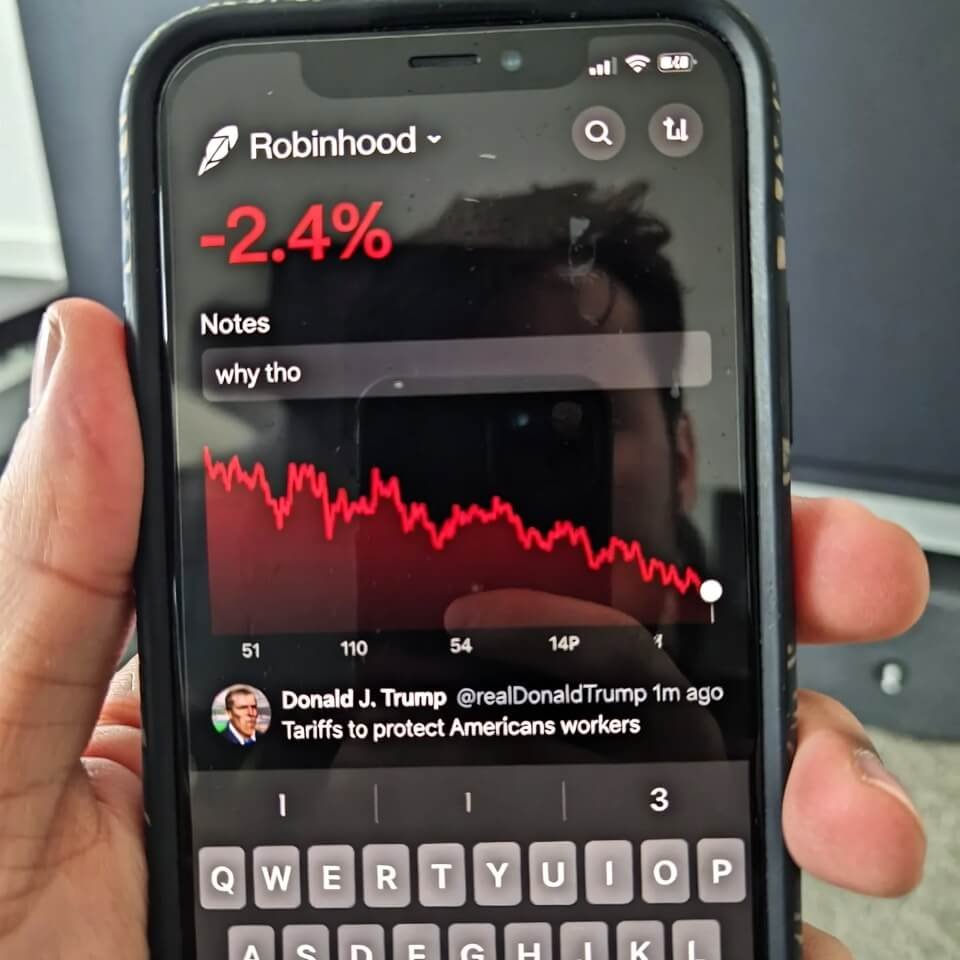

Okay real talk: how markets react to trade war headlines every day is honestly starting to feel like psychological warfare aimed directly at my cortisol levels. I’m sitting here in my cramped home office in [some mid-sized US city, think Raleigh or Boise vibes—not naming it because OPSEC], blinds half-shut against the February gray, chugging black coffee that’s gone cold again because I keep refreshing Bloomberg like it owes me money.

Seriously, every morning I wake up, check my phone, and within 47 seconds there’s some new tariff threat or “Phase One deal back on” rumor and bam—my watchlist looks like it’s having a seizure. One day it’s soybeans getting obliterated because China’s supposedly buying from Brazil instead, next day it’s Boeing bouncing because “talks are constructive.” I swear the market has the emotional stability of a toddler on a sugar crash.

Why How Markets React to Trade War Headlines Every Day Feels So Personal

Look, I’m not some hedge fund bro with three monitors and a Bloomberg terminal that costs more than my car. I’m just a guy who got into individual stocks during the 2020 dip, thought I was smart, and now I check my portfolio roughly 18 times a day like it’s Tinder matches.

Last Tuesday I had this exact sequence:

- 7:42 AM: Open CNBC app → headline “Trump considering 25% tariffs on EU autos”

- 7:45 AM: SPY down 0.8%, my industrials ETF bleeding

- 7:51 AM: Some random verified account tweets “sources say tariffs delayed”

- 7:53 AM: Instant green candle, my position up 1.1%

- 8:04 AM: Official White House statement walks it back → red again

I literally laughed out loud alone in my kitchen. My dog looked at me like “dude you okay?”

The Dumb Things I’ve Done Because of Trade War Market Reactions

- Panic-sold CAT calls because a headline said “China may retaliate on heavy machinery.” Re-bought them 40 minutes later at +18%. Smooth.

- Tried to “fade the news” on soybean ETF (SOYB) three separate times. Lost money every single attempt. Apparently the market doesn’t care about my contrarian theories.

- Stayed up until 1:17 AM watching after-hours futures because some X post said “Xi Jinping personally reviewing deal terms.” Spoiler: nothing happened. I just aged faster.

The volatility from trade war headlines isn’t just numbers—it’s emotional whiplash. One minute you feel like a genius, next minute you’re googling “can I write off therapy if it’s market-related?”

What Actually Moves the Needle (My Flawed Observations)

From staring at this mess day after day, here’s what I’ve noticed about how markets react to trade war headlines every day:

- Initial knee-jerk — first 15–60 minutes is pure panic or euphoria, usually overdone.

- Fade or continuation — by midday, algos and real money start deciding if the headline has legs. 70% of the time it fades unless there’s an actual policy doc drop.

- Sector rotation insanity — ag plays (DE, ADM), semis (if chips get dragged in), industrials (CAT, HON), and consumer discretionary (NKE gets weirdly sensitive sometimes) swing hardest.

- VIX loves this shit — any fresh tariff rumor and the fear index pops like it’s been waiting for an excuse.

Outbound links for credibility because I’m not just ranting into the void:

- Check the actual timeline of recent tariff spats on Council on Foreign Relations trade war tracker

- Real-time market reaction breakdowns on Yahoo Finance tariff headlines archive

- My guilty pleasure read: ZeroHedge live blog during headline dumps (take with salt lick)

Wrapping This Chaos Up Before I Refresh Again

Honestly? How markets react to trade war headlines every day has taught me more about my own patience (or lack thereof) than any trading book ever could. I still haven’t figured out how to stop doom-scrolling headlines at breakfast, but I’ve at least started waiting 30 minutes before hitting buy/sell. Small wins. If you’re also glued to your phone watching the red-green-red-green dance, drop a comment—what’s the dumbest trade you’ve made because of a trade war headline? I’ll go first in the replies.